June Alinsco Update

- Don Owens

- Jun 18, 2024

- 1 min read

Here's a look at what is happening in the Texas auto insurance market.

Some carriers are easing their underwriting, deductibles and down payments, but rates continued to rise. Auto and home insurance rates continue to be the most inflated of consumer expenses across the United States.

Here are the latest estimated rate changes for last month for Texas auto insurance:

AmWins cut off their cheaper Excel product, but re-opened the higher-priced Value product.

Venture General no longer offering quotes on vehicles with COL/OTC coverages.

Rate Changes in SERFF:

Amica +11.5%

Foremost (1.3%)

Root +9.1%

Hidden amounts from: Loya, SeaHarbor, Falcon, Mendota, Vision, AssuranceAmerica, PointRider, Constitution

Rate Changes Detected in ITC Data:

Lonestar Maverick +7%

AmWins Value +73% (not a typo) on full coverage; +30% on liability only

Pronto: down 5%

Venture General +7%

As we move through an election year, the main thing on the mind of most American's is inflation and the impact they feel from the dramatic rise in cosumers expense since 2021.

Car insurance inflation leads the way as insurance companies adjusted to the increase in vehicle values, growing labor costs, medical costs, and sky rocketing litigation.

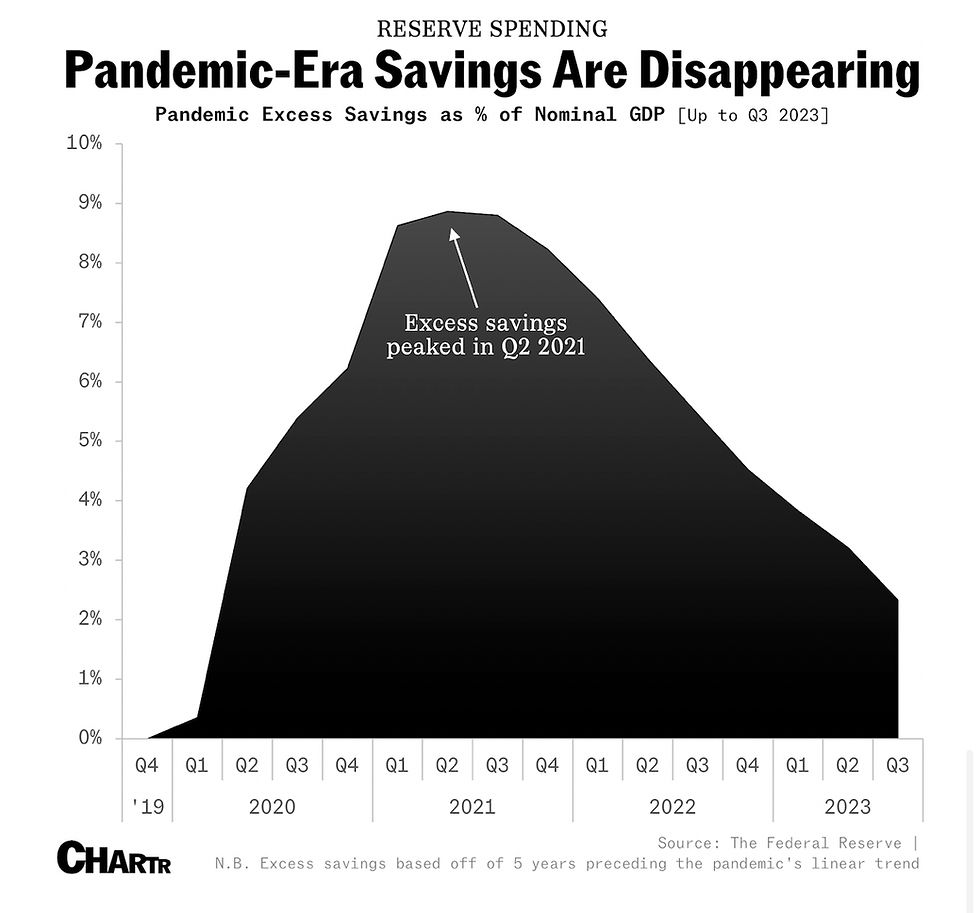

The excess savings consumers built during the pandemic era is disappearing as the cost of living rises.

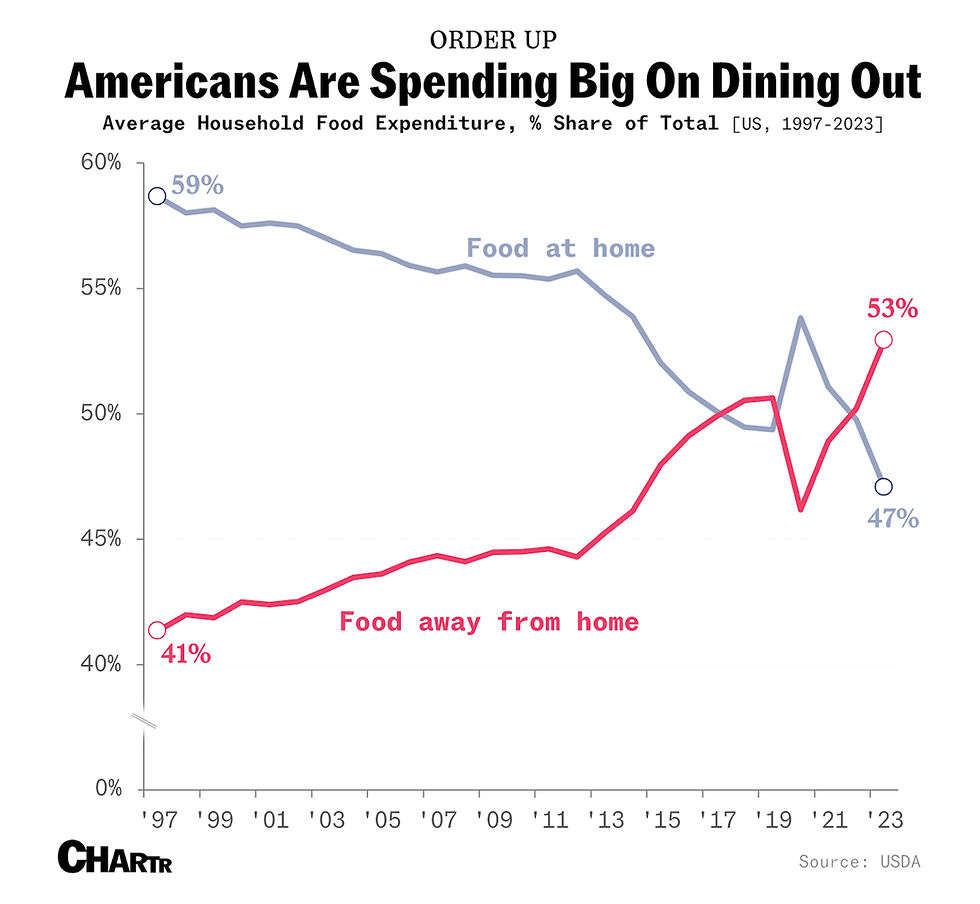

In spite of all this, consumers are still willing to spend more for dining out.

Comentários